The tips and tricks you should know before taking a loan.

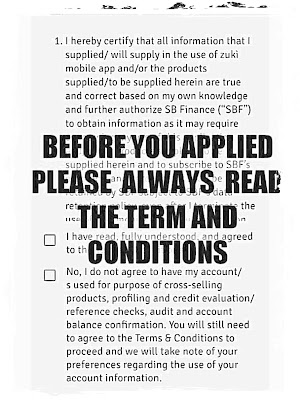

1 . Know the accompanying terms and conditions of a loan.

Most of the loans are associated with conditions such as Monthly payment, due date, term length, annual interest rate, fees and fines. When you are thinking to take a loan, regardless of its sources consider the teems and conditions because they can leave you definitely in debt.

Knowing the terms and conditions of a loan will enable you to make the right decision and then avoid the consequences of violating the terms and conditions of a loan.

2 . Set strategies for how to repay the loan.

3. Know the repayment schedule of the loan.

How a great deal you all pay every month in your lender. a number of these goes in the direction of paying down your loan predominant quantity and a few are going in the direction of paying down your interest. Hence knowing the loan repayment schedule will enable you to make the right decision and then avoid the consequences of violating the terms and conditions of a loan.

4 . Know the interest rate for the loan repayment.

Annual interest rate (APR).This measures how high-priced your loan is, using combining your interest fee and any finance fees into one amount. you could use this to save round and examine specific loan terms. Banks are institutions that do enterprise for income; banks do enterprise, particularly via loans. it is important to be more careful and sensitive to the interest charge you will be charged on the loan. The high the interest rate, the more difficult it is to repay. Many human beings are becoming into severe hassle after finding themselves in debt with high-interest fees. make certain the interest you will be charged for is not much high and evaluate if you can afford it before you accept the loan. This will enable you to make the right decision and then avoid the consequences of violating the terms and conditions of a loan.

5 . Take loans for investment purposes only.

6 . Make sure you have loan protection insurance to secure the loan you take.

7 . Understand other loan associated costs.

Loan costs, till include fees which include origination charges, application charges, oversees or prepayment consequences. Not all kinds If loans apply the same terms and associated charges, some apply loose conditions and others set fixed tough associated costs. So before you take a loan, consider the associated costs since this will enable you to make the right decision and avoid the consequences of the terms and conditions of a loan.

8 . Consider the loan lifecycle for repayment.

That is the quantity of time you need to pay off your loan, as mentioned above. The longer the mortgage is, the decrease its month-to-month interest rate. So it's far very crucial to test the loan duration to assess if you may come up with the money to pay off the loan in the allocated time.

9 . Diversify the loan investment to reduce risk.

10 . Accept a loan with batch repayments.

If you are planning to borrow, then don't take easy the loan repayment means. Choose to repay it via batch or let's say repay it after every month. These are the crucial things to take into account earlier than making use of a loan.

11 . Define your monetary capabilities.

Conclusion.

A private loan is a facility via which you could fund deliberate and unplanned prices.

However, like any loan, it's more profitable a debt that you must pay off in the stipulated terms and to do so, make sure you observe the above tricks to avoid violating the terms and conditions of a loan.

You can pay off the loan by using adopting various practices like budgeting, cutting down needless prices, and so forth but all in all, observe the tricks to avoid violating the terms and conditions of a loan.

If you select to pay off the loan earlier than the stipulated term, make certain to check if there are prepayment penalties.

0 Comments